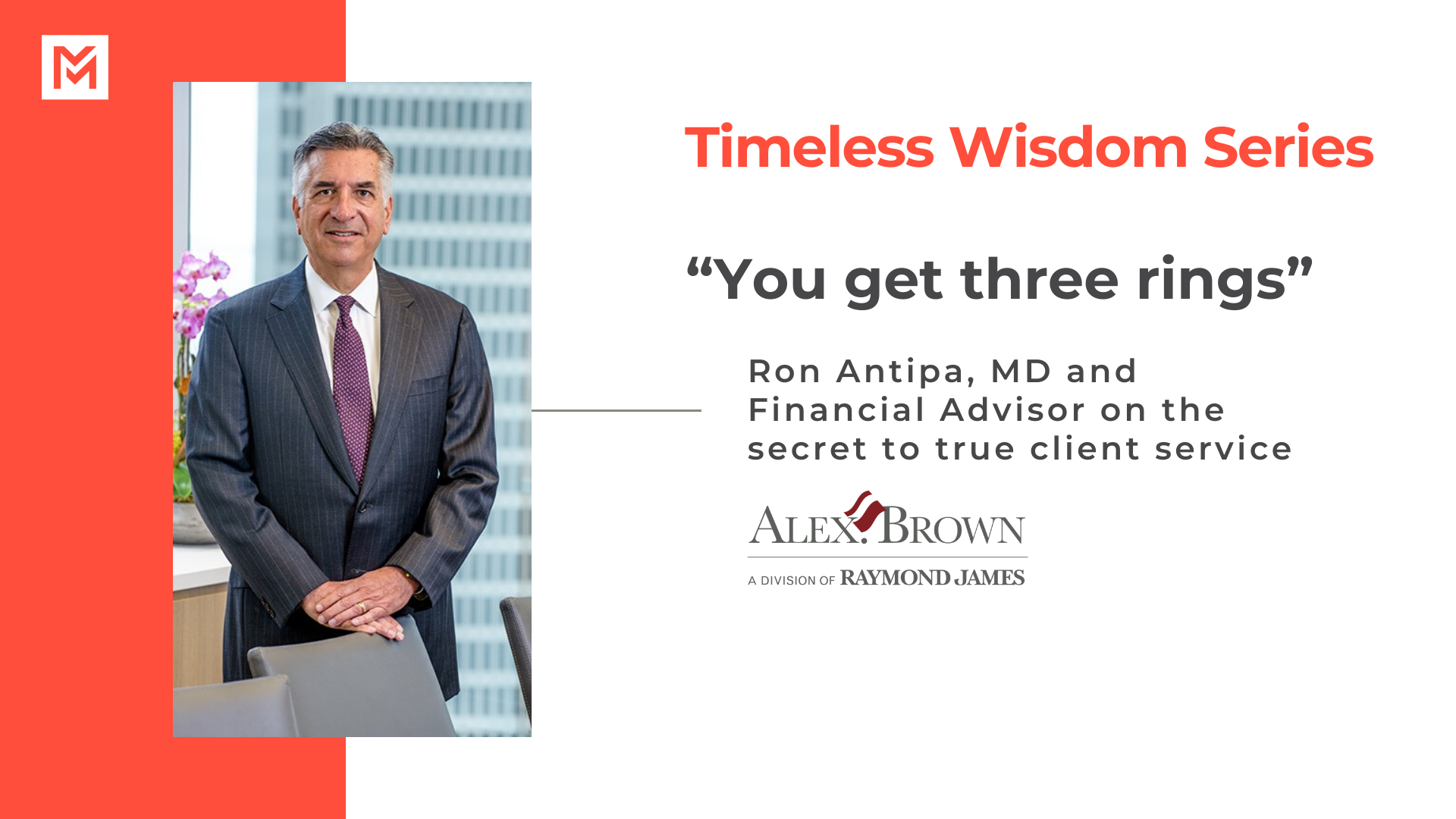

Welcome to our new series Timeless Wisdom where professionals in financial services explain the unchanging essence of what it means to attract and help grow an enduring portfolio of clients.

Companies today like to pontificate on the merits of different types of communication. For instance, do you use asynchronous? (I leave a message, you call back.) Automated? (Talk to a chatbot.) Self-serve? (Log into the portal and make changes yourself.) But nobody is arguing about the fact that there is no replacing the good old-fashioned phone call to attract and help grow an enduring portfolio.

“At one point I had the CEOs of two of the top California companies as clients and I could get a call back from them faster than from my family,” Ron Antipa, the Managing Director and Financial Advisor at Alex. Brown, a division of Raymond James. The reason these CEOs would return his call so quickly? For one, they had a lot of people calling them and if they ever fell behind, they’d be buried. But two, they knew that without fail, within three rings, Ron would pick up and resolve their issue.

Finance has never ceased to be about people

In early 2018, Bank of America joined dozens of other banks in launching its own consumer-facing chatbot named Erica. The digital assistant aims to provide a sort of automated self-help service, fetching account information and articles. Within months nearly one million customers were engaging with it. The most common use case? Asking to speak to a human.

The financial sector has gone, by some measures, positively mad about encouraging clients to help themselves. No doubt, clients are demanding it. Indexing and robo-advisors are on a sharp rise. Yet lost amidst all the fervor is the fact that, for requests where they need to feel certain, 86 percent of people prefer talking to a human.

Ron’s clients have always known that he and his business partner are reachable. If called, Ron or Samantha would answer and resolve things swiftly. But unlike automated interactions or support with an agent who may or may not follow through, Ron’s clients leave the call assured that the thing is, in fact, complete and won’t come back to haunt them. In an age where finicky digital services flicker in and out of availability, people will pay for reliability. So imagine the advantage that accrues to an advisor who’s reliably just a few rings away.

“The business I built was very client-centric. I don’t think we can say that’s exactly standard operating procedure for many brokers today,” says Ron. And who can blame them? Quotas are higher than in the past and a premium is placed on specialization. Brokers are encouraged to do more prospecting and push things off onto money managers. “Now it’s all about new business,” says Ron. This leads to some awkward situations.

Ron was recently talking to a new advisor. He asked the price of a company stock and she replied, “Wait a second, let me get on to Yahoo.” ‘You get your stock quotes from Yahoo?’ Ron wondered. “How do you do business?” he asked. Her reply: “Well, we do not trade stocks. We just lend money.”

“In moments like that, new advisors who say ‘We just’ are teaching their customers that they don’t know any more than the client does, even if that’s not true,” says Ron. “You will never look bad for knowing more. Be their financial guide. Have answers. Know the stocks. It’s part of your presentation, it’s how you build a relationship, and how you acquire a portfolio where you don’t always have to be chasing new business.”

We take great pride—and Covid-19 hasn’t changed that

Much changed for Ron and his team with Covid-19. The biggest impact was that in the office, he and his business partner Samantha could quickly answer each other’s phones.

“We take great pride in taking a phone call within three rings. We answer each other’s phones. I don’t care what you’re doing, put whoever you’re with on hold. I want them to have a live person on the phone to help them deal with their circumstances. You may have to say, ‘Hey I’m on a conference call, is this something that can wait two minutes? Oh sure, call me back,’” he says.

Now at home, Ron has recreated his setup to a degree. He’s on his cell phone and on a Voice Over Internet Protocol (VoIP) connection on his laptop. He gives his cell to clients and his VoIP line to colleagues from the firm or other traders. He can see who calls, and he knows that if it comes through his cell, it’s important. And even if it’s not strictly important, it’s still important to Ron.

That’s because even if Ron’s caller is looking for a wire, has lost their 1099, or needs a P&L, and could find what they’re looking for through a client portal, they probably don’t. They never will. Because they have Ron and his extended team who always picks up. Many have been clients for decades and no new technologies will wrest them away from him. As things change, his client roster won’t. Ron has attained the ultimate in client longevity, and it’s built on a habit of answering within three rings.

To learn more about how MultiLine by Movius can help, you can learn more here

By: Tara Panu, VP of Marketing, Movius