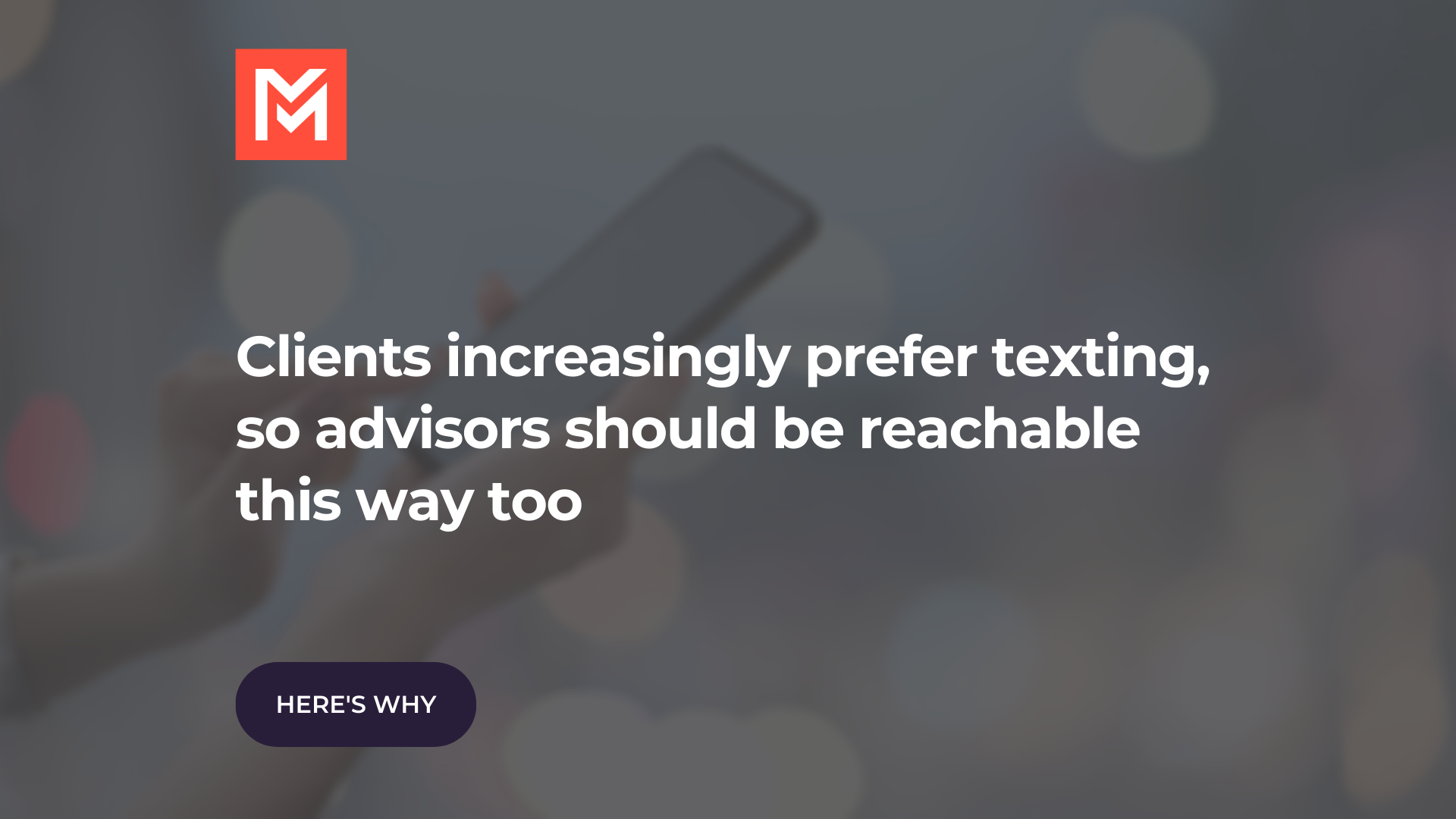

In almost every sector, we increasingly see the use of text messaging. From tracking packages to picking up prescriptions, to customer service, to mobile banking—people now expect that they can use SMS to add convenience to all areas of their life. So why haven’t more financial advisors adopted texting as a way to communicate with customers? And what benefits can incorporating text and other virtual technologies bring to firms?

Is texting risky business—or is it having no texting policy at all?

When texting first arrived on the scene, soon the compliance and security challenges with the new medium became apparent. Fearing exposure to litigation, financial services responded to this risk by a blanket ban on text messages. However, with the pressures on advisors to meet customer expectations, you can’t depend on a ban to prevent costly fines. Neither will a ban prevent customers from initiating text conversations, which should be recorded as a business record. If an advisor replies to the text to request the conversation move to a managed channel, this is still a compliance risk. If the advisor ignores the text, this risks injuring the relationship.

It’s impossible to be completely sure that advisors might not send or respond to texts on the down-low. Your firm having a written electronic communications policy doesn’t prevent liability for failing to preserve and produce records. In 2017 and 2018, there were cases where FINRA fined brokers for engaging in unapproved securities-related text communications and there are already three cases this year.

Most violations stem from the general requirement to capture, supervise, and produce business communications. MultiLine ensures reliable, compliant mobile communications for remote bankers, wealth advisors, mortgage advisors, relationship managers, and more.

Not only is it hard to prove whether advisors are using text if you don’t have a texting policy, but you’re also missing out on the benefits texting and other digital tools can add to customer engagement and your advisor-client relationships.

MultiLine for calls and texts is the choice for financial advisors, virtual and in-person

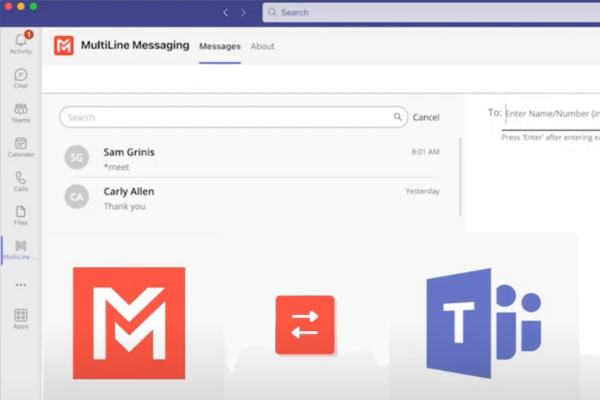

Movius maintains a laser focus on the needs of leading global financial firms and their advisors. We’ve developed the MultiLine application to support your firm’s ability to capture and produce all your texts and calls and to easily implement other business functions, such as SMS Opt-In and Lexicon Policies.

- Easily deploy, secure, and manage the MultiLine app with leading providers like Microsoft Intune, BlackBerry Dynamics, Workspace One, and MobileIron.

- Highly configurable to meet your needs, we provide options to record just voice, just SMS, or both no matter on Wi-Fi, data, or GSM.

- Enjoy multiple recording, storage, and retrieval options, including the option of real-time SIPREC recording or seamless data transfer to your archive or CRM of choice.

For IT and compliance teams, MultiLine includes a management portal that provides transparent audit trails, alerts, and reports to help compliance and mobility teams meet obligations and maintain visibility across all business voice and text.

Deliver concierge-like customer service from anywhere

Financial advising is a personal process where supporting your relationship with the client is of utmost importance. Responsiveness is the name of the game, and it’s easiest to do that by giving your clients multiple channels to get in touch with you.

- Texting provides more flexible ways of interacting compared to email. Brief messages such as “do you have time to talk?” can let the customer know you want to connect. Advisors can regularly check-in with their clients, building a strong relationship (Check out our 6 steps compliant texting guide here).

- Virtual advising, whether via calls, texts, or video conferencing, appeals to customers who may be traveling, can’t make it to a branch, or simply don’t want to make the commute. The ability to reach out with multiple channels with a phone call or text delivers convenience to these customers.

Increase advisor productivity

When it comes to recordable and producible communication, many advisors aren’t putting their reputation and career on the line on purpose, it may be because they’re lacking the tools or it isn’t convenient.

- Being able to deploy the separate business number on their device, giving them access to their clients when on the go, can altogether prevent the urge to communicate with a non-compliant channel. With a solution that protects the advisor’s privacy and is easy to use and configure, the advisors are far more likely to comply with regulations.

- Because MultiLine works for Wi-Fi calls, cellular data, and GSM, advisors can stay compliantly in touch with clients—at home, traveling, at the office—wherever they’re doing business.

- When you implement MultiLine with the Salesforce CRM connector, business conversations that are facilitated through the MultiLine app are automatically captured and logged inside Salesforce, with full features of an employee’s business line on any desktop browser. This integration increases productivity with features such as quick-reply texts, as well as the ability to add notes during or after calls to help automate daily tasks.

Rollout quickly and easily

Our solution is already trusted by leading top global banks and financial firms. Our customer success team will guide you every step of the way. Deploy to 1,000s in days with users up and running in minutes, with no visit to the office required since onboarding the cloud-based service is entirely online and over-the-air.

- Works on any mobile device and carrier

- Works in any environment

- Works around the world

If you’re on board to provide your financial advisors the tools they need to provide customers exceptional service—and auditors excellent documentation—our customer success team is ready to help.