Hybrid Work Is Here.

Revenue teams everywhere are suffering from less effective communication, difficulty managing performance, and increased compliance risk. The urge to text and reassure clients is overwhelming. With a compliant mobile messaging solution, they can, and it shows in their performance.

Read the guide to learn:

- How to inspire your remote revenue team

- How to empower the team with compliant mobile messaging

- Plays you can run

Chapter 1:

Goals Haven't Changed. Work Has.

On March 14, 2020, it became clear that the novel coronavirus was not like SARS. This time, the virus had penetrated North America and was spreading with alarming speed. Among the first and hardest hit locations was the financial center of New York City. What ensued was the greatest migration of computer keyboards and borrowed office monitors from buildings to homes ever—with cords and severed connections trailing in their wake.

Before the shift, 29% of financial services firms allowed employees to work from home at least once per week. These were primarily called center workers, claims adjusters, and the like. By May, that number had leaped to 69%, and now it was everybody, save for a few categories of trader. Despite a few minor easements from FINRA around call recording requirements, the message from leadership and the regulators was clear: Work must go on.

Office life has changed dramatically but quotas have not. Nobody is predicting a return to any sense of normalcy vis-à-vis visiting offices. It is estimated that most firms plan to shed between one- and two-thirds of their office footprint and adopt hybrid models with floating desks, suburban hubs, and so much more Zoom.

Firms plan to shed between one- and two-thirds of their office footprint.

The questions for leaders of revenue teams are, “How do I ensure my team makes their number?” and “How do I retain talent and equip them with the right tools to engage clients?” To answer these questions, Movius conducted conversations with dozens of top-performers across roles and firms to isolate their top challenges. Everyone’s chief concern? Building relationships at a distance.

As we’ll explore in this guide, if leaders do nothing else, allowing advisors, wealth managers, traders, and investment bankers to securely call, text, and WhatsApp with clients is a huge leap toward helping them increase client engagement and hit quota— especially when competitors can’t

Chapter 2:

The Hybrid Work Challenge

One of the most pronounced lessons leaders have taken away from remote work is that productivity appears to slump at first. The situation is of course complicated by the closing of schools. Many at-home workers were also doubling as teachers and caretakers for children and family, and people are understandably distracted by new equipment, rules, and lack of precedent.

As workplaces adapt to a new hybrid model, revenue leaders will continue to face three challenges:

Ineffective Client Communication

#1 reason affluent clients fire their advisor: lack of communication.

Remote revenue teams are less effective at communicating with clients and closing deals. So-called “Zoom fatigue” is real and clients increasingly want to fall back on their channels of choice, such as WhatsApp and SMS.

Forcing clients to adapt to officially-sanctioned channels during an already stressful time creates unnecessary friction, and diverts wealth managers or advisors from talking about goals and building a relationship.

Investment bankers, still often on the go, must pause to open their laptops and log into VPNs, and traders are limited to the slow, asynchronous drip of email for trade confirmations. In all cases, it makes transacting difficult.

Risk: Fewer deals, longer cycles

61% of financial services CFOs say they plan to make remote work permanent for roles that allow it. – PWC CFO Survey

Difficulty Managing Performance

Leaders are less able to manage the performance of revenue teams. In-person, they’re able to overhear chatter and drop in for informal coaching conversations, whereas remote work often keeps them in the dark. Rather than listen, they’re forced to schedule blocks of recurring meetings and advisors or bankers don’t get to ask questions in the moment, when it matters.

A related challenge is asking teams to enter timely and accurate information in the CRM. With so much digital communication, they tend to be slower at entering information—often waiting until the end of the week or month to log calls, by which time, they’ve forgotten important details or the interaction entirely.

Risk: Less effective coaching, slower onboarding, higher churn

Poor performers consume 17% of a leader’s time. – The Economist

Errors for us are skyrocketing. People are distracted. Comms between bosses and sales assistants and brokers aren’t as accurate. Something isn’t as clear as it was. – Managing Director at a Global Investment Bank

Compliance Risk

Distracted and stressed teams are more likely to make mistakes. This is particularly difficult as personal and professional spaces blur, and clients demand to text or WhatsApp. While your business can ban agents from texting, you can’t ban clients from doing so. This puts employees in compromising situations where responding to a text can seem like the difference between earning someone’s confidence and breaking it.

Pile onto this the fact that there’s often too little guidance. In the office, traders, for instance, learn and check each other by asking their neighbor if something is above-board. At home, they can’t ask the question unless it’s over an official channel, and so they often don’t. This leaves employees circling in an endless loop of wondering, “Can I say this?” This delays and complicates their outreach and responses.

Risk: Inconsistent client experience, greater compliance risk

ILLICIT ACTIVITY TENDS TO SPIKE DURING TIMES OF UNCERTAINTY

In October 2020, two of the most senior commodities executives at Morgan Stanley left after compliance breaches linked to WhatsApp. – Bloomberg

In sum, agents, reps, and wealth managers are less able to build the types of relationships that lead to deals. Leaders have less visibility and are less able to coach them, and they live in a world that increasingly tempts them to do things like text when they know they shouldn’t. However, all of these issues can be addressed with compliant mobile messaging.

Chapter 3:

The Mobile Messaging Difference

Most discussions about working from home make a big, incorrect assumption: that it happens from a fixed space. Increasingly, workers are mobile and prefer to work on the go, from their phones or tablets.

Investment bankers and wealth managers, for instance, are more likely than ever to log CRM information from their smartphone. This is partly thanks to improved mobile apps, and partly due to changing social mores. More senior types, having long glorified out-of-date handsets, are upgrading their devices—some under pressure from their security teams, others out of a need to stay connected digitally.

If left unchecked, mobile can of course present a workflow risk. If mobile apps aren’t connected to desktop applications such as the CRM, they create duplicate work. An advisor may have to log mobile interactions after the fact on their desktop. But this is well-solved for by a category of system known as a compliant mobile messaging service. Movius, for instance, gives relationship managers (RMs) and advisors one business phone number they can use for calls, texts, and even WhatsApp conversations, and everything is logged in the CRM as it happens.

A compliant mobile messaging service can:

- Capture conversations automatically, on mobile or desktop

- Operate on a work or personal device

- Capture consent with an opt-in / opt-out button

- Block PI and offensive language

- Serve as a searchable log of communications

- Automatically log conversations in the CRM

Such a service allows revenue teams to permit mobile and messaging communications that they’d otherwise have to ban. This solves the three largest problems of remote work: client communication, performance management, and compliance risk.

It Improves Client Communication

Consumers and clients want to text. Eighty-five percent say it’s their preferred mode of communication and only 12% want to receive calls from banks and advisors—and that holds true across age groups. Mobile messaging opens a direct, personal channel.

82% of people open every text message they receive.

It Helps Leaders Manage Performance

When all calls and texts are recorded, leaders can listen in. Depending on the interface, managers can make a practice of reviewing calls, which they can see from within the CRM, and provide more direct and timely feedback. They gain visibility into how remote advisors are interacting with clients and can coach accordingly, in real-time.

Continuous feedback reduces turnover by 15%. – Gallup

It Erases Compliance Concerns And Eliminates Busywork

Confident communicators are quick communicators. With guardrails like auto-capture and the ability to block personal information like account numbers or sensitive phrases like “guarantee,” RMs and advisors know they’re free to send and reply. And when conversations are automatically logged in the CRM, they’re both more accurate (an exact transcript with timestamps, rather than notes), and it saves them time they can repurpose toward prospecting and relationship building.

As we’ll explore next, this can have a serious impact on teams’ ability to manage clients, especially amidst a pandemic.

Global Investment Bank Launches Compliance Mobile Messaging

Shanghai Pudong Bank Launches MiFID II Compliant Communications

Home Lending Startup Launches Compliant Texting

The challenge of course for all teams is that software isn’t the complete solution. For it to truly be effective, compliant mobile messaging must be paired with process, which we discuss in the next chapter.

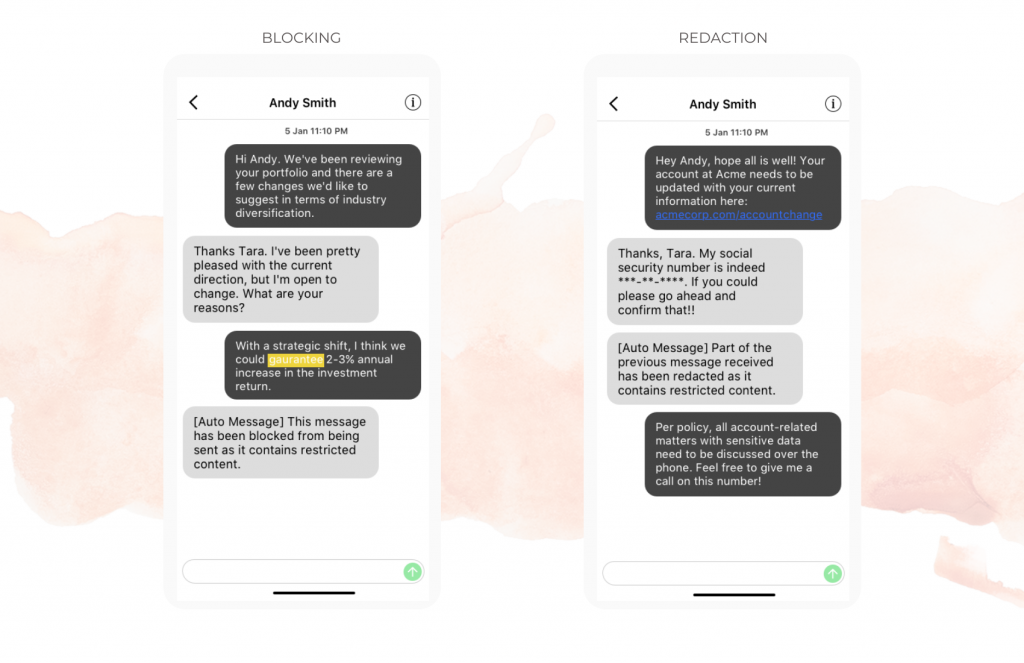

How Does Message Filtering Protect Revenue Teams?

Message filtering is the ability to block and redact sensitive information within messages, automatically. For instance, the system can block a text if the banker uses the word “guarantee,” or redact a Social Security number from a WhatsApp message.

Position Yourself for the Next Generation of Clients

The great wealth transfer is underway and younger investors are seeking advice in new ways. Forward-looking businesses are preparing with compliant mobile messaging.

Chapter 4:

The Revenue Messaging Curve

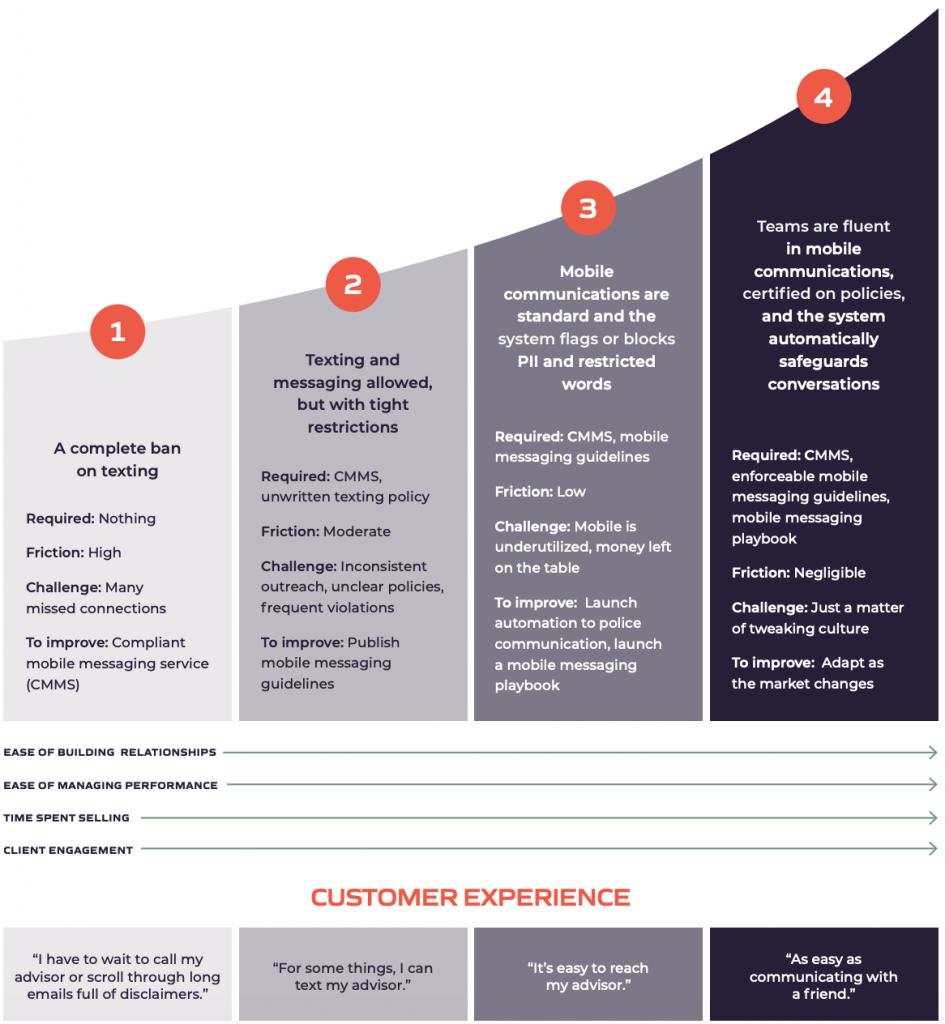

Not all revenue teams with a compliant mobile messaging service are successful. And not all successful teams have a mobile messaging service (although most do). The reason is, success relies on a combination of technology, people, and process.

To help you understand how to deploy a compliant mobile messaging service in a way that empowers RMs, traders, wealth managers, and the like, we’ve produced a maturity curve. It reflects what the most effective organizations are doing down to the least effective, with guidance for how to ascend the curve.

At the top of the curve are organizations like JP Morgan Chase & Co. and UBS. At these firms, select teams are unencumbered thanks to guidelines and training. As a result, they create deeper relationships at a distance.

The Mobile Messaging Curve

In the next chapter, we cover exactly what it can look like to use your newfound tools and process to empower your team.

Chapter 5:

Plays to Run

How you make use of compliant mobile messaging and the plays you run depend on the type of team. In this chapter, we cover scenarios for wealth managers, advisors, investment bankers, traders, and consumer bankers. If you don’t see your use case here, reach out to the Movius team.

One important point before you begin: Your teams will need to be reminded repeatedly, for months, that with compliant mobile messaging, texting is above-board. The biggest hurdle to teams enacting these strategies to attract and retain more clients is a knee-jerk avoidance of texting due to historical texting bans.

Below, a list of points you can borrow when communicating that messaging is allowed:

- Anything sent through Movius (or similar) is above-board

- Movius will automatically capture client consent

- Texting or WhatsApp is only allowed through Movius (no personal numbers)

- Advise clients to only text or WhatsApp with your Movius number

- Avoid trading or advising—only for relationships and logistics

- There are automatic checks to block PII, offensive language, and emojis

- These messages are monitored by compliance

- We can set it up so messages are automatically logged in the CRM

- All conversations can be automatically sent to your existing compliance archive

Wealth Managers

Play: Offer market guidance and emotional support

Allow wealth managers to initiate text or WhatsApp conversations with clients who they’ve already interacted with. Texting opens a channel where, unlike email, clients can let loose and be candid. Wealth managers are able to send links to research and reports which include a custom disclaimer, just like in email.

Key Benefit: Free to text and create stronger personal relationships

- Understand changing buying patterns

- Capture consent

- Automatically block PI and sensitive language

- Analyze conversations for compliance

- Automatically log messages in CRM

Use it to offer:

- Market updates

- Research

- Emotional support

- Trade confirmations

- Logistics “I’m running late”

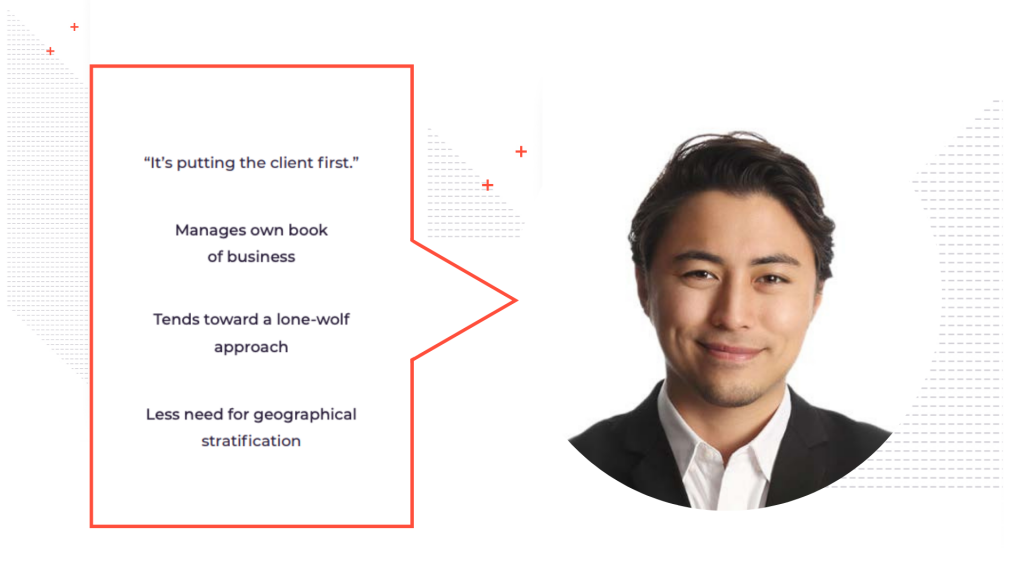

Advisors

Play: Break out of infrequent, quarterly reviews with frequent messaging contact

Allow advisors to offer their “cell phone” to clients to text them, as a personal touch. Once initiated, advisors can use texting to check-in, keep deals warm, and provide validation or investment ideas. For home advisors, buying a home may be the largest purchase their client will ever make—being on a texting basis increases their confidence. Messaging can be especially effective if advisors are virtual and aren’t limited by geographic territory. One advisor can manage dozens of simultaneous text conversations as opposed to just one phone conversation.

Key Benefit: Build trust and loyalty

- Capture texts for compliance and sales training

- Capture consent

- Automatically block PI and sensitive language

- Analyze conversations for insights

- Automatically logged in CRM

Use it to offer:

- Validation

- Ideas

- Answers

- Logistics “I’m running late”

Investment Bankers

Play: Frequent, informal client communications that are automatically logged

For investment bankers always on the go or on the phone, the ability to automatically log all conversations frees them up for more important things. Saved conversations can serve as meeting minutes, accessible through the CRM. And the ability to text can help secure appointments and navigate last-minute changes.

Key Benefit:

- Analyze conversations for insights

- Automatically logged in CRM

- More candid interaction with the client, less administrative work

Use it to offer:

- Channel for clients to vent

- Reassurance

- Logistics “Is Jordan joining us?”

- Research

Traders

Play: Increase call volume without disrupting their workflow, improve relationships

For traders accustomed to trader turrets and 6-8 screens in the office, work from home has been a rocky transition. Arm them with a way to modernize and consolidate their messaging with text threads and WhatsApp. For clients and other traders, it’s a convenience. For the traders, it’s both time-saving and alleviates their concerns about violating regulations.

Key Benefit:

- Frequent voice communication helps traders convey nuance, build trust

- Analyze conversations for compliance

- Automatically logged in CRM

Use it to offer:

- Trade confirmations

- Research

- Quick answers

- Increase call volume without disrupting their workflow, improve relationships

Commercial Bankers

Play: Add a personal touch and offer a third channel

With messaging, commercial bankers can manage more simultaneous conventions that also feel more personal. Because 98% of text messages are read within two minutes, it gives them a powerful way to send updates, ask for non-personal information, manage logistics, and maintain people’s attention.

Key Benefit: Better relationships, faster cycles, less admin work

- Automatically block PI and sensitive language

- Capture consent

- Automatically logged in CRM

Use it to offer:

- Personal touch

- Links and ideas

- Confirm appointments

- Non-sensitive advice

- Logistics “I’m running late”

Chapter 6:

What's Next

Attaining Your Team’s Number This Year

More and more, being a ‘trusted advisor’ is not enough. Today’s clients expect a close relationship, proactive advice, and communication over channels like SMS or WhatsApp that are convenient for them. Having a team with a high mobile messaging maturity is a quick path there, and is a great start. It also opens up a universe of possibilities. When all calls and messages are compliantly recorded, and you have access to the data, you can begin to model what ideal communications look like. For instance, you can identify and templatize what sort of outreach is correlated with larger or faster transactions, and distribute it to the rest of your team. With a provider like Movius, these sorts of AI and analytics are embedded, and part of a promise that once you begin to improve, client success becomes a self-reinforcing cycle. Today, amidst a pandemic, clients want reassurance and better service. Compliant mobile messaging is your first step there, and an insurance policy that you’ll be ready—no matter what’s next.